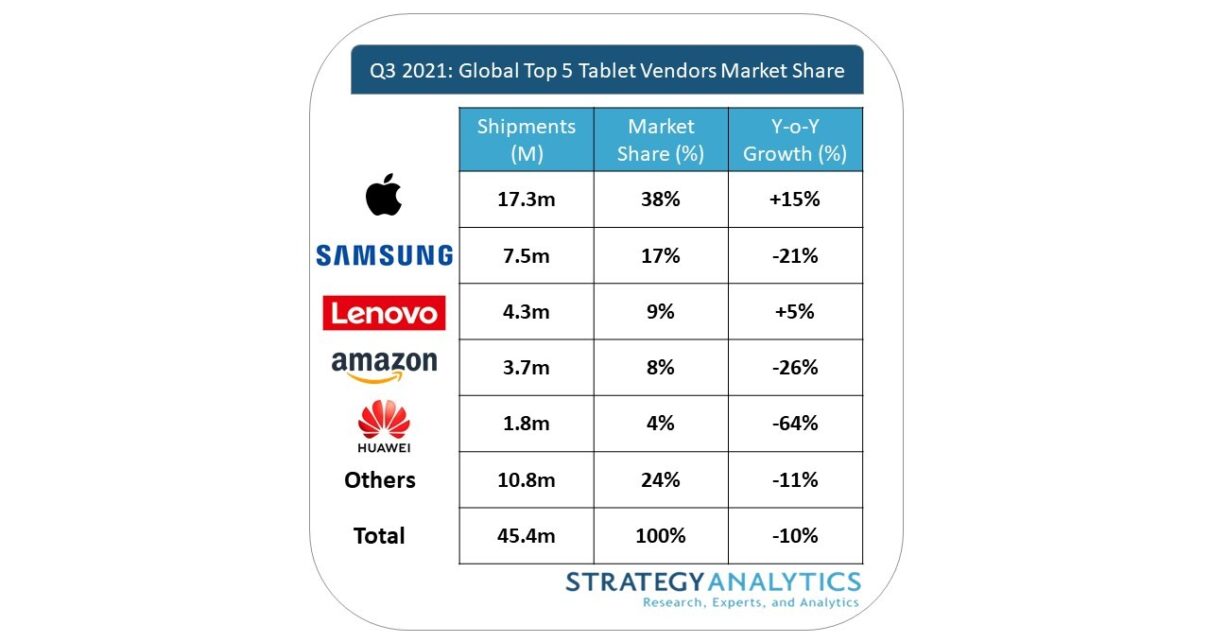

The tablet market saw a 10% drop in shipments year-on-year, but market demand is still far stronger than it was pre-pandemic with people working from home, according to a new report by Strategy Analytics. Apple managed to buck the trend with shipments up 15% year-over-year and 38% of the tablet market share on the strength of new versions of the iPad, iPad mini and iPad Pro.

As the COVID pandemic remains a key concern around the world, this tension between high demand and low component supply will test vendors and their channel partners as we enter the winter holiday season.

Eric Smith, Director – Connected Computing for Strategy Analytics said, “With a portfolio stocked with highly capable productivity tablets, Apple’s strong growth came at the expense of other vendors competing for tight supplies. Vendors selling Windows Detachables like Lenovo, Dell, and HP showed healthy growth during the quarter as Microsoft was still working with an old portfolio of Surface devices. All of this plays to the larger trend of consumers continuing to work remotely (or at least in a hybrid schedule) and keep connected with digital learning platforms as the new school year began.”

Chirag Upadhyay, Industry Analyst added, “The China tablet market was hot in Q3 and vendor performance mirrored vendor access and brand perception in China. For example, Apple, Lenovo, Xiaomi, and Honor posted some of the strongest year-on-year growth rates while Samsung, Amazon, and Microsoft experienced growth rates declining by double digits. As the pandemic disrupts life in different regions at different times, we expect supply to remain tight and demand to generally remain higher than pre-pandemic levels.”

- Apple iOS/iPadOS shipments (sell-in) grew 15% year-on-year to 17.3 million units in Q3 2021, with worldwide market share climbing 8 percentage points to 38%

- While remaining the top Android vendor, Samsung tablet shipments declined -23% year-on-year in Q3 2021 to 7.5 million units; market share declined by -2.1 percentage points to 17% during the same period.

- Lenovo tablet shipments showed the only year-on-year growth out of all Android vendors at 5% to reach 4.3 million units; market share climbed 1.4 percentage points year-on-year to 9%

- Amazon Fire tablet shipments fell -24% to 3.7 million units as market share fell -1.4 percentage points to 8%

- Huawei tablet shipments fell year-on-year -64% to 1.8 million units in Q3 2021. Market share fell 6.0 percentage points to 4% compared to Q3 2020