Apple became the largest smartphone manufacturer on the strength of the new iPhone 15 lineup, overtaking Samsung.

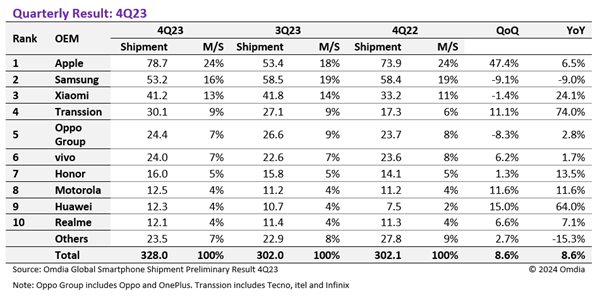

The latest data from research firm Omdia found that in the fourth quarter of 2023, the smartphone preliminary shipment total reached 328 million units. This marks an 8.6% increase compared to 4Q22, and highlights 4Q23 as the first quarter to see a significant increase since 2Q21. It is also an 8.6% increase compared to the previous quarter.

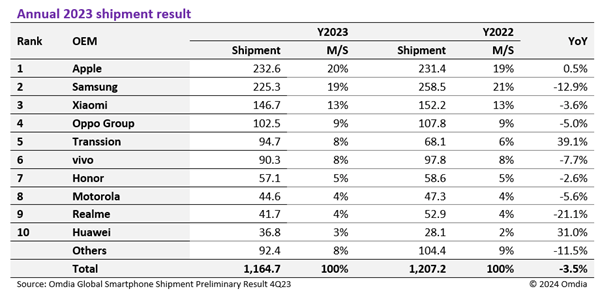

This growth signals an end to nine consecutive quarters of year-on-year declines in overall smartphone shipments, a sign that the industry is stabilizing after a period of strong smartphone demand between 4Q20 and 3Q21, followed by supply chain problems in 2022. Every single major OEM recorded year-on-year growth other than Samsung, with Xiaomi, Transsion and Huawei all having significant growth of more than 20%. Despite this growth, Omdia research shows that the 2023 shipment total is now 1,164.7 million units, a 3.5% fall from the 1,207.2 million total for 2022.

With the launch of the iPhone 15 series, Apple recorded the highest shipment total for 4Q23, with 78.7 million units. This is a 6.5% increase from the previous year, with the launch of the iPhone 14 series. This is the largest quarter for Apple since 4Q21.

Samsung recorded 53.2 million unit shipments in 4Q23, a 9% fall from 4Q22. This means that Samsung is the only major smartphone OEM that has had lower shipments every quarter of 2023 than the same quarter in 2022. This resulting fall indicates that the 2023 total for Samsung is 12.9% lower than 2022 – 225.3 million in 2023 compared to 258.5 million in 2022. This could be the result of the collapse in demand for mid and low-end price tier phones, and therefore Samsung A-series phones, following a sustained period of high inflation and increasing cost of living globally.

Xiaomi has retained its shipment figures from the previous quarter, recording 41.2 million unit shipments in 4Q23. This is a slight 1.4% dip from the 41.8 million in 3Q23, but a significant 24.1% increase from 4Q22. This is a good sign that Xiaomi is recovering from a sustained period of falling market share, even among a falling overall market. By keeping these shipment numbers, Xiaomi is retaining and strengthening its position as the third largest OEMs globally. This is not to say that it is immune to competition, there is still stiff rivalry from other Chinese OEMs Oppo, vivo, and increasingly, Transsion Holdings.

Transsion Holding has increased its shipments even further to 30.1 million in 4Q23, this is an increase of 11.1% from the previous quarter. This sustained growth over the past year has resulted in 4Q23 figures, being a staggering 74% increase from 4Q22. This makes Transsion the fourth largest OEM in 4Q23, having overtaken both vivo and Oppo and now leading them by more than 5 million units.

“The high growth of Transsion Holding in 2023 is mainly due to the following aspects: firstly, solved inventory issues ahead of industry. Secondly, consumer downgrading caused by global inflation, as the products that Transsion Holding focuses on perfectly match the current needs. Thirdly, the active market expansion strategy that has taken place in 2023 has provided better market conditions for shipping,” said Zaker Li, Omdia Principal Analyst.

Oppo Group recorded 24.4 million shipments in 4Q23, an 8.3% fall from 3Q23. Despite this, it is a 2.8% increase from the 23.7 million in 4Q22. This highlights that Oppo is now recovering its shipment numbers from a period of decline over 2022 and early 2023. It has, however, only begun recovering recently and not at the same rate as other OEMs, meaning it has lost market share and fallen from fourth to fifth in the overall smartphone OEM rankings.

Closely following Oppo is vivo recorded a 6.2% increase quarter-on-quarter to 24.0 million units. This is a 1.7% increase from the previous year, too, as the Chinese domestic market recovers, it is clear that vivo is slowly recovering shipment figures it lost over 2022 and 2023 again, too. Although this is still far below the shipments it recorded in late 2020 and 2021 and has not quite reached the levels pre-2020. As its key markets are China and the rest of Asia, vivo will be more beholden to changes in those markets, than other Chinese OEMs who have greater presence in Latin America, Europe, or the Middle East and Africa.

Honor recorded 16.0 million unit shipments, a small 0.2 million or 1.3% increase from the previous quarter, but a large 1.9 million or 13.5% increase from the previous year. Honor has recorded one of the smallest dips in cumulative shipments for 2023 compared to 2022 – 57.1 million in 2023 compared to 58.6 million in 2022. All other major OEMs other than Apple, Huawei, and Transsion Holdings had more dramatic declines in 2023.

The positions of 8th, 9th and 10th have seen a reshuffle in the last quarter of 2023. But all three of Motorola, Huawei and Realme were within 0.4 million units of one another.

Rising from 9th to 8th is Motorola, who recorded 12.5 million units, up 11.6% both quarter-on-quarter and year-on-year from the 11.2 million in both 3Q23 and 4Q22. This increase of 1.3 million is above expectations, with Motorola seeing decline in every other quarter of 2023. Due to this late recovery in the year, the cumulative shipments for 2023 is 5.6% lower in that of 2022 – 44.6 million compared to 47.3 million.

Rising from 10th to 9th is Huawei, who has recorded a bigger rise: increasing 15% from 3Q23 from 10.7 million to 12.3 million units in 4Q23. Compared to the previous year, this is a massive 64% increase from the 7.5 million units recorded in 4Q22. Huawei has in fact had year-on-year growth every quarter since 3Q22 and throughout all of 2023. As a result, its cumulative total for the year is 31% higher than the total for 2022 – increasing from 28.1 million to 36.8 million. This sustained growth has only been beaten by Transsion’s rapid expansion in the second half of 2023.

Falling from 8th to 10th is Realme, who has also recorded growth like the others, but a smaller growth. It recorded 12.1 million units in 4Q23, up from 11.4 million in 3Q23 and 11.3 million in 4Q22. Although Realme has been outrun by other brands and as a result have fallen down the shipment rankings. This is not a big surprise; Realme has seen a large decline in its smartphone shipments in 2023, with every other quarter being large year-on-year declines. This last minute, eleventh-hour growth doesn’t stop Realme from seeing the worst decline over the whole of 2023 than any other major smartphone OEM. It recorded 41.7 million shipments in 2023, a 21.1% fall from the 52.9 million recorded in 2022.

“The smartphone business in 2023 was determined by the products and regional markets each brand focuses on. While Apple, which concentrated on the premium market, recorded relatively good performance despite a decrease in overall market demand, the performance of major Chinese OEMs highly concentrated in the Chinese and Indian markets decreased significantly compared to the previous year due to the impact of the slump in smartphone demand in these two countries. Samsung, which has a high proportion of low- to mid-priced smartphones, also suffered a significant decline in shipments as its sales of mid- to low-priced smartphones were affected by the economic recession across the regions and was forced to give up its first place to Apple,” said Jusy Hong, Senior Research Manager, Omdia.

The smartphone market in 2024 is expected to return to growth compared to last year, but Omdia predicts that there is a possibility for it to turn to negative growth in the second half of the year compared to last year due to the economic recovery delay, geopolitical instability, and the growing used phone market.