SAN JOSE — PayPal is rolling out a new app to customers on Android and iOS.

The all-in-one, personalized app will introduce new features including PayPal Savings, a new high yield savings account provided by Synchrony Bank, alongside new in-app shopping tools that will enable customers to earn rewards redeemable for cash back or PayPal shopping credit and uncover deals with hundreds of merchants.

While the new app is available for download today, the PayPal Savings feature and shopping tools won’t be available for another few months.

Additionally, the new app offers PayPal customers a single place to manage their bill payments, get paid up to two days earlier with the new Direct Deposit feature provided through one of our bank partners, earn rewards and manage gift cards, send and receive money to friends, family and businesses, pay with QR codes for purchases and redeem rewards in-store, access and manage credit, Buy Now, Pay Later services, buy, hold and sell crypto, as well as support causes and charities they care about.

The new app includes a personalized dashboard of a customer’s PayPal account, a wallet tab to manage payment instruments and Direct Deposit, a finance tab that includes access to high yield savings and crypto capabilities, and a payments hub that includes send and receive money features, international remittances, charitable and non-profit giving, bill pay, and a two-way messaging feature to send notes of acknowledgment after peer-to-peer transactions.

The number of consumers using digital wallets is expected to double to 4.4 billion globally by 2025, and nearly half of consumers (48%) already cite simplicity as the top reason to use a digital wallet. The new PayPal app aims to address this by offering an all-in-one app as the primary destination for customers to easily manage their day-to-day financial lives.

“We’re excited to introduce the first version of the new PayPal app, a one-stop destination for our customers to take charge of their everyday financial lives, with new features like access to high yield savings, in-app shopping tools for customers to find deals and earn cash back rewards, early access Direct Deposit, and bill pay,” said Dan Schulman, president and CEO of PayPal. “Our new app offers customers a simplified, secure and personalized experience that builds on our platform of trust and security and removes the complexity of having to manage multiple financial or shopping apps, remember different passwords and track loyalty rewards.“

In the coming quarters, PayPal plans to add new features and enhancements to the app, including investment capabilities and more ways to pay with the app online and in-store, including the ability to pay with QR codes in an offline environment and enhanced PayPal-branded capabilities that offer new ways to shop and save in-store.

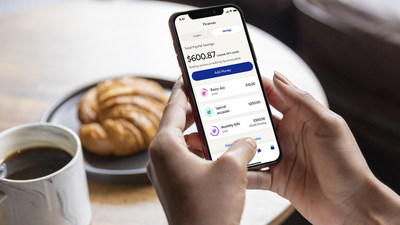

PayPal Savings is provided by Synchrony Bank and offers customers a way to access a competitive high yield interest rate and can help encourage the development of healthy savings habits. With the average national savings account only offering customers an interest rate of 0.06%, PayPal Savings enables access to a savings account with a competitive 0.40% Annual Percentage Yield (APY), that is more than six times the national average, with no minimum balance or monthly fees. Customers can also create savings goals with visuals of what they want to achieve and track their progress, while automatic transfers to PayPal Savings can help create regular habits and achieve financial goals.

Customers can easily transfer money between PayPal Savings and their PayPal balance to use on purchases with PayPal. Interest amounts are provided to the customer at the end of their statement period on a monthly basis. PayPal Savings is planned to start rolling out to customers in the U.S in the coming months.