MOUNTAIN VIEW — Financial software company Intuit Inc. has introduced QuickBooks Solopreneur, a new product designed to meet the unique needs of one-person businesses. The comprehensive tool provides a number of easy-to-use features to help solopreneurs stay in control of their finances, create trackable goals, manage business expenses to stay tax-ready, and have the confidence to drive financial stability, all in one place.

According to the Intuit QuickBooks Entrepreneurship in 2024 Report, solopreneurs are increasing in numbers as more people take the leap to work for themselves. Nearly a quarter of U.S. consumers said they plan to start a new business in 2024, and two-thirds believe that starting a business is a better path to building personal wealth, even when compared to buying a house.

“Many solopreneurs are at that critical phase where they need to better understand their business to chart a path to financial stability,” said Michael Hitchcock, vice president, Accounting and Tax, QuickBooks. “QuickBooks Solopreneur is designed specifically for one-person businesses who crave simplicity and don’t yet require an advanced accounting solution. It enables them to get a holistic view of their finances, manage daily operations, and be ready for tax time so they can grow on their own terms.”

QuickBooks Solopreneur includes a suite of intuitive tools and features. With QuickBooks Solopreneur, business owners can:

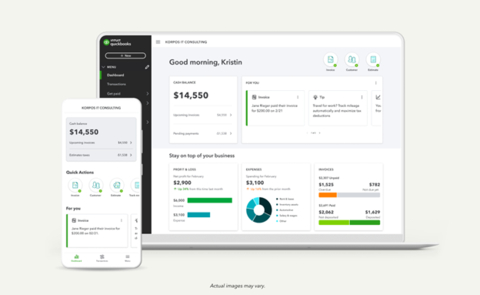

- Manage books, all in one place: Access transaction management tools that automatically separate business and personal transactions into categories for easy review, and connect bank accounts and import spreadsheet data for a full view of operations. Plus, customers can seamlessly track mileage, create and send customized invoices and estimates, view reports, and more.

- Utilize tools and insights to drive business decisions: Easily view income, expenses, and profit with simple reports and dashboards to stay in control of cash flow in real time. Customers can also set up trackable goals, view insights, and see recommended actions to help them to make smarter business decisions and achieve goals.

- Make tax time less taxing: Stay tax-ready year-round with tools that auto-track miles on-the-go through the QuickBooks mobile app, and easily categorize business trips for accurate tax time deductions for business expenses. Customers can also move seamlessly from books to taxes to easily prepare and file tax year returns directly in QuickBooks, and access expert help through QuickBooks Live Assisted Tax, powered by TurboTax, to help them file with confidence.

Adding to the growing solopreneur community are side-giggers, who currently run their own business in addition to working a day job. These individuals have set clear financial goals before they plan to commit to solopreneurship full–time. More than half of America’s side-giggers said they won’t quit their day job until their side business earns $50,000 – $100,000, and one in three (33%) say their business is currently making less than $25,000. QuickBooks Solopreneur can help both aspiring and current solopreneurs reach these financial goals, wherever they are in their business journey.

“Being able to seamlessly navigate the features has made a tremendous impact on the financial health of my business,” said Dr. Brenda Sacino PT DPT, owner of Playful Progress in Bedford, NH and a QuickBooks Solopreneur beta customer. “Having started my business less than a year ago, I was worried about having to account for everything myself, but QuickBooks Solopreneur has kept me organized and made the financial management painless!”

Built on the expertise gained from serving self-employed business owners with QuickBooks Self-Employed, which launched in 2015, QuickBooks Solopreneur provides an elevated experience with added flexibility and productivity tools designed for the needs of one-person businesses, to help them set financial goals and further grow. Additionally, QuickBooks Solopreneur will soon offer a more seamless experience across the QuickBooks ecosystem to meet a solopreneur’s growing needs, including upgrading to QuickBooks Online and accessing other QuickBooks tools and services.

QuickBooks Solopreneur is available to customers in the U.S. beginning today online and is compatible with the QuickBooks mobile app on iOS and Android.