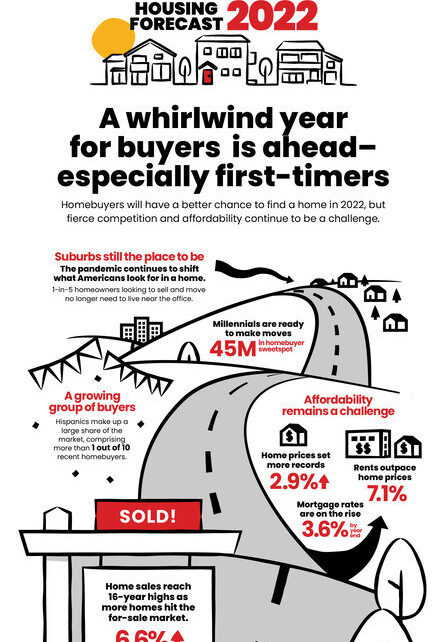

SANTA CLARA — Americans will have a better chance to find a home in 2022, but will face a competitive seller’s market as first-time buyer demand outmatches the inventory recovery, according to the Realtor.com 2022 Housing Forecast. The median home price is expected to rise 2.9% next year but rents are projected to go up even higher at 7.1%.

In the San Jose-Silicon Valley area, Realtor.com is projecting prices will go up 4.2% next year but house sales dropping in the area by 4.0%. The San Francisco-Oakland-Hayward area will see prices go up 5.5% and home sales down 5.2%.

“Whether the pandemic delayed plans or created new opportunities to make a move, Americans are poised for a whirlwind year of home buying in 2022. With more sellers expected to enter the market as buyer competition remains fierce, we anticipate strong home sales growth at a more sustainable pace than in 2021,” said Realtor.com Chief Economist Danielle Hale. “Affordability will increasingly be a challenge as interest rates and prices rise, but remote work may expand search areas and enable younger buyers to find their first homes sooner than they might have otherwise. And with more than 45 million millennials within the prime first-time buying ages of 26-35 heading into 2022, we expect the market to remain competitive.”

Realtor.com forecasts strong 2022 home sales and competition, as first-time buyers overwhelm recovering inventory levels

Realtor.com forecasts 2022 home sales (+6.6% year-over-year) will hit their highest level in 16 years as buyers remain active and for-sale inventory begins to recover from recent steep declines. 2022 buyers will face a competitive seller’s market, with record-high listing prices, fast-paced sales and limited for-sale home options as existing-home listings continue to lag behind pre-COVID levels. The new construction supply gap of 5.2 million new homes may shrink somewhat in 2022 as builders continue to ramp up production with a projected increase of 5% year-over-year.

With prospective sellers planning to increasingly enter the market this winter, Americans can look forward to more opportunities to make a successful home purchase. Affordability will be a growing consideration as mortgage rates and home prices rise, but a growing economy, strong employment market and workplace flexibility will enable more home shoppers to successfully buy their first homes without breaking their budgets. Additionally, with rents forecasted to grow at a faster annual pace (+7.1%) than for-sale home prices (+2.9%) in 2022, homebuying may become the more affordable option, when compared to renting, in many markets. Despite the challenging market, the homeownership rate is expected to grow slightly in 2022 (65.8%).

|

Metric (National) |

2022 Realtor.com |

2021 Realtor.com Housing |

|

Existing Home Sales |

+6.6% year-over-year |

6.0 million |

|

Existing Home For-Sale Inventory |

+0.3% year-over-year |

-18% year-over-year |

|

Existing Home Median Sales Price Appreciation |

+2.9% year-over-year |

+12% year-over-year |

|

Rent Growth |

+7.1% year-over-year |

+8% year-over-year |

|

Mortgage Rates |

3.3% (avg); 3.6% (year-end) |

3.0% (avg); 3.2% (year-end) |

|

Single-Family Housing Starts |

Up 5% over 2021 |

+15% year-over-year |

|

Homeownership Rate |

65.8% (year-end) |

65.5% (annual average) |

2022 housing trends reflect new homebuying opportunities combined with the past decade of growing challenges

- Millennials fuel fierce first-time buying competition for limited inventory through 2025: Millennial housing demand has been rising for years, but the pandemic ignited a first-time buying frenzy as the decade-long housing shortage converged with new opportunities for young buyers to pursue their first homes. Recent survey data shows millennials account for over half (53%) of prospective buyers who plan to purchase their first home within the next year. Despite positive signs of inventory’s return to growth in 2022, this first-time buyer demand is expected to outmatch both new and existing-home inventory. As a result, home shoppers will face fierce competition in 2022 – and for at least the next three years as millennials finish their first time buying years, the relatively smaller Gen Z population increasingly enters the housing market, and more older Americans begin downsizing for retirement.

- Housing affordability issues will be a mixed bag: While historically-low mortgage rates helped buyers better manage monthly housing costs in 2021, affordability will be an important consideration in 2022 as mortgage rates climb and home prices continue to rise 2.9%. However, a number of factors will help keep homeownership in reach for many buyers, including expected income growth of 3.3% by year end and declining unemployment, expected to drop from a projected 4.8% in the last three months of 2021 to 3.5% during the same time period in 2022. Additionally, with rental prices expected to surge in 2022 as they catch-up from below-average growth seen during COVID, many markets may offer more affordable monthly first-time buying costs relative to rents.

- Shifting workplace dynamics create new homebuying opportunities: From workplace flexibility to higher incomes, 2022 will see employees call the shots on issues that will play an increasingly important role in the housing market. As the economy grows and unemployment declines, bigger paychecks will enable buyers to compete even as housing costs rise, while more power to negotiate flexible workplace arrangements will allow home shoppers to explore lower-priced housing markets further from expensive city centers. In fact, recent survey data shows nearly one-in-five prospective sellers (19%) are looking to move because they no longer need to live near the office, up from just 6% in the spring.

- COVID compounds demand for more space – both inside and outside the home: Demand for more space has been a consistent trend throughout the pandemic and one that is expected to carry into 2022. With the number of Realtor.com viewers of suburban home listings rising 42.1% since the onset of COVID, the suburbs will continue to be more popular than big urban metros as home shoppers search for relatively affordable and larger homes. Recent data suggests builders will account for buyer preferences for more space in their 2022 production plans as new single-family homes have begun to get larger. However, with demand expected to outpace new construction growth and the typical 2,000 square foot single-family home price still rising at a double-digit annual pace in October (+16.7%), buyers may have to sacrifice extra space in order to afford a home in their desired area.

- Homeowner diversity will play an increasingly important role in the market: With U.S. demographic diversity increasing in younger generations, populations like Hispanic Americans will play a growing role in the 2022 housing market. Although they are underrepresented among homebuyers relative to their share of the population, the number of hispanic home shoppers is rising at a faster pace than non-Hispanics. Additionally, as the majority of new hispanic homeowners fell in the critical first-time buyer category, the population will increasingly drive housing demand and impact the homeownership rate in 2022 and beyond.

“Our Housing Forecast suggests that we’re in store for another dynamic year of activity, but 2022 will also come with growing pains as we navigate the path forward from the height of the pandemic toward a new normal,” said George Ratiu, Manager of Economic Research for Realtor.com. “With most real estate markets expected to be competitive in 2022, it’s important to remember that you’re in the driver’s seat of your real estate journey. The bottom line for buyers is to make sure you’re comfortable with your timeline and budget – and especially for younger buyers making this massive financial decision for the first time. For sellers, take into account your local market conditions as well as the likely increase in the number of homes for sale, and price yours competitively. The good news is that sites like Realtor.com provide more advanced digital real estate tools than ever before, including personalized matching to high-quality real estate agents in your local area, to help you chart the best path forward for you and your family.”

Homebuyers can use Realtor.com tools like its affordability calculator to get a sense of how much they can afford in the 2022 housing market, as well as the Realtor.com app to set up personalized searches and price alerts on new listings matching their criteria. Additionally, sellers can use Realtor.com resources like My Home and Seller’s Marketplace to explore multiple home valuations, instant offers from Opendoor, the Knock Home Swap for those buying a next home at the same time, and more.

Realtor.com 2022 Housing Forecast – 100 Largest U.S. Metros (in alphabetical order)

|

Metro |

Forecasted 2022 Home |

Forecasted 2022 Home |

|

11.4% |

4.5% |

|

|

-0.9% |

4.0% |

|

|

3.9% |

4.4% |

|

|

4.0% |

4.3% |

|

|

10.0% |

3.5% |

|

|

3.5% |

4.1% |

|

|

4.7% |

3.0% |

|

|

-4.2% |

6.1% |

|

|

-2.4% |

3.2% |

|

|

-1.8% |

1.5% |

|

|

8.1% |

5.6% |

|

|

12.9% |

7.9% |

|

|

3.9% |

7.5% |

|

|

0.7% |

2.5% |

|

|

4.3% |

4.5% |

|

|

-5.6% |

2.7% |

|

|

2.7% |

4.6% |

|

|

9.9% |

5.6% |

|

|

3.7% |

6.9% |

|

|

-2.6% |

1.9% |

|

|

7.9% |

5.4% |

|

|

7.8% |

4.2% |

|

|

10.3% |

5.2% |

|

|

6.4% |

5.1% |

|

|

13.7% |

6.3% |

|

|

8.3% |

4.0% |

|

|

10.7% |

4.3% |

|

|

0.6% |

6.1% |

|

|

6.0% |

5.0% |

|

|

5.9% |

3.9% |

|

|

6.3% |

5.6% |

|

|

8.9% |

4.2% |

|

|

10.6% |

5.1% |

|

|

3.7% |

5.9% |

|

|

6.6% |

7.1% |

|

|

6.6% |

5.3% |

|

|

11.4% |

5.7% |

|

|

4.4% |

3.5% |

|

|

-2.9% |

0.7% |

|

|

2.6% |

2.4% |

|

|

14.8% |

5.5% |

|

|

4.7% |

3.5% |

|

|

6.2% |

6.5% |

|

|

11.0% |

4.7% |

|

|

3.3% |

5.9% |

|

|

6.5% |

7.0% |

|

|

0.1% |

5.9% |

|

|

6.7% |

3.4% |

|

|

-1.6% |

4.8% |

|

|

7.3% |

4.5% |

|

|

6.2% |

3.9% |

|

|

5.9% |

5.1% |

|

|

7.4% |

6.6% |

|

|

3.6% |

5.8% |

|

|

10.5% |

2.4% |

|

|

4.1% |

6.0% |

|

|

5.5% |

5.6% |

|

|

-1.8% |

1.0% |

|

|

0.7% |

5.0% |

|

|

-3.0% |

2.3% |

|

|

0.8% |

1.7% |

|

|

3.7% |

2.6% |

|

|

8.2% |

4.9% |

|

|

8.8% |

5.4% |

|

|

-2.2% |

4.4% |

|

|

7.4% |

7.9% |

|

|

4.7% |

2.9% |

|

|

7.5% |

6.8% |

|

|

8.3% |

3.5% |

|

|

-0.2% |

10.0% |

|

|

6.1% |

4.3% |

|

|

8.1% |

9.5% |

|

|

9.6% |

4.3% |

|

|

5.0% |

4.9% |

|

|

-1.4% |

5.5% |

|

|

8.3% |

4.0% |

|

|

6.0% |

5.0% |

|

|

6.8% |

1.7% |

|

|

15.2% |

8.5% |

|

|

5.1% |

3.5% |

|

|

0.2% |

4.8% |

|

|

-5.2% |

5.5% |

|

|

-4.0% |

4.2% |

|

|

3.6% |

1.1% |

|

|

9.6% |

7.5% |

|

|

12.8% |

7.7% |

|

|

6.1% |

6.6% |

|

|

1.0% |

7.8% |

|

|

5.7% |

4.4% |

|

|

9.6% |

6.8% |

|

|

11.0% |

2.4% |

|

|

8.0% |

6.2% |

|

|

0.8% |

1.8% |

|

|

-3.9% |

0.2% |

|

|

11.8% |

2.7% |

|

|

5.6% |

3.8% |

|

|

7.4% |

6.3% |

|

|

5.9% |

5.8% |

|

|

8.4% |

8.2% |

|

|

7.3% |

6.9% |