SAN JOSE — Clear Digital, a Silicon Valley-based digital agency that’s been driving digital performance for top B2B brands for over 20 years, has received 12 prestigious ADDY Awards from the American Advertising Federation of Silicon Valley (AAF), including three Gold ADDY Awards, one Judge’s Choice Award, and one Best of Show—the highest level of recognition. Conducted annually, the American Advertising Awards […]

Adobe Unveils Photoshop With Generative Fill and Generate Image

LONDON — At Adobe’s MAX London Conference – the company unveiled the all-new Photoshop (beta) with breakthrough advancements in Generative Fill now with Reference Image, delivering greater control for creators and superpowers for all Photoshop users to confidently create amazing images. Powered by Adobe Firefly Image 3 Foundation Model, these innovations are ushering in a new era of the world’s […]

Apple Targets Small Businesses With In-Store Programs

Beginning in May, select Apple stores around the country will offer a special Today at Apple series titled “Made for Business” that will give small business owners and entrepreneurs free opportunities to learn how Apple products and services can support their growth and success. Led by small business owners, the sessions will highlight how these […]

Rippling Raises $200 Million in New Financing

SAN FRANCISCO — Rippling announced it has raised $200 million in new financing, and signed agreements with investors to repurchase up to $590 million of equity from current employees, former employees, and early investors. The financing was led by Coatue with participation from Founders Fund, Greenoaks, and other existing investors. Dragoneer is joining the round […]

OpenAI Opens Japanese Office

OpenAI is growing operations internationally and is expanding into Asia with a new office in Tokyo, Japan. The company says it is collaborating with the Japanese government, local businesses, and research institutions to develop safe AI tools that serve Japan’s unique needs and to unlock new opportunities. OpenAI chose Tokyo as its first Asian office […]

Juicer Milks $5.3 Million Seed Round

SAN FRANCISCO — JUICER, a provider of restaurant revenue management and pricing solutions, has completed a $5.3 million seed round led by York IE. Restaurants are undergoing a profound shift, becoming an e-commerce category thanks to the rise of delivery and digital customer engagement. In this new world, traditional pricing and promotions no longer suffice. […]

Clazar Raises $10 Million Series A

SAN FRANCISCO — Clazar, a company powering software businesses to sell and grow revenue through cloud marketplaces (AWS, Azure, and GCP), has raised a $10 million Series A funding round led by Ridge Ventures and Ensemble VC, with participation from Saurabh Gupta, Managing Partner at DST Global, and existing investors including The General Partnership and […]

Property Brother Drew Scott Invests in Quilt

REDWOOD CITY — Quilt, a smart home climate solution company, has raised $33 million Series A funding round co-led by Energy Impact Partners and Galvanize Climate Solutions, with participation from Lowercarbon Capital, Gradient Ventures, MCJ Collective, Garage Capital, Incite Ventures, and Drew Scott from HGTV’s Property Brothers. Quilt was founded because 20% of U.S. global […]

Avive Scores $56.5 Million

SAN FRANCISCO — Avive Solutions, Inc., a developer of the world’s most advanced connected automated external defibrillator (AED) – the Avive Connect AED – announced the closing of a $56.5 million growth equity financing. The round was led by Questa Capital, Laerdal Million Lives Fund (LMLF), and Catalyst Health Ventures, and welcomed several new investors including RC […]

Uniqus Consultech Reels In $10 Million

SAN JOSE — Uniqus Consultech, a tech-enabled global platform that offers ESG and Accounting & Reporting Consulting, has raised $10 million in Series B funding. The round was led by Nexus Ventures with participation from Sorin Investments. In just over a year of launch, Uniqus has offices in eight cities across the US, India, […]

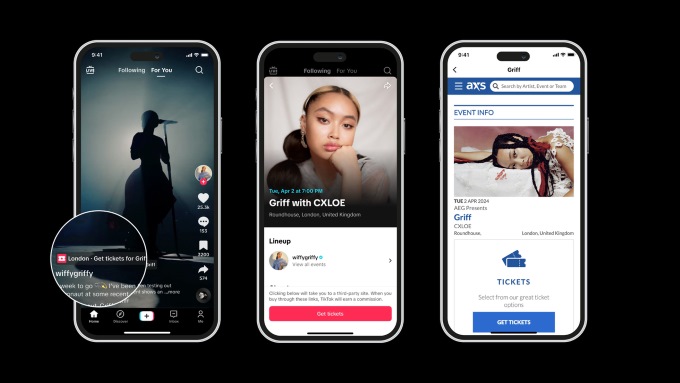

TikTok to Sell Tickets With AXS

TikTok has launched a new partnership with AXS, a leader in global ticketing, to offer fans a new way to discover and buy tickets to live events for their favorite artists. The partnership promises to bring music fans closer to their favorite artists, with the feature live in the US, UK, Sweden and Australia. Now, […]

Apple Airplay Available at IHG Hotels

Guests staying at select properties from IHG Hotels & Resorts, including Kimpton Hotels & Restaurants, Hotel Indigo, Candlewood Suites, and InterContinental Hotels & Resorts, can use AirPlay to privately and securely stream their favorite shows and movies on Apple TV+ and other popular streaming services, listen to personal playlists on Apple Music or other platforms, […]