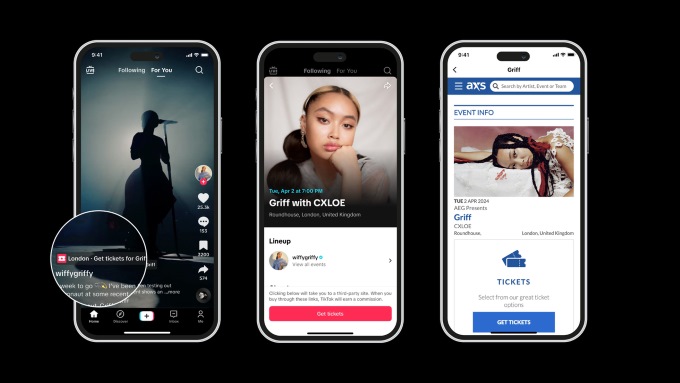

TikTok has launched a new partnership with AXS, a leader in global ticketing, to offer fans a new way to discover and buy tickets to live events for their favorite artists. The partnership promises to bring music fans closer to their favorite artists, with the feature live in the US, UK, Sweden and Australia. Now, […]

Apple Airplay Available at IHG Hotels

Guests staying at select properties from IHG Hotels & Resorts, including Kimpton Hotels & Restaurants, Hotel Indigo, Candlewood Suites, and InterContinental Hotels & Resorts, can use AirPlay to privately and securely stream their favorite shows and movies on Apple TV+ and other popular streaming services, listen to personal playlists on Apple Music or other platforms, […]

Two Chairs Sits Down With $72 Million

SAN FRANCISCO — Two Chairs, a behavioral health company, announced the closing of a $72 million Series C equity and debt financing round led by Amplo with Fifth Down Capital, and other investors also participating. Bridge Bank provided the debt financing. This latest round brings the total capital raised to $103M. Two Chairs has grown 8x over the last 36 months and now has […]

Rivos Scores $250 Million Series A-3 Round

SANTA CLARA — Rivos, a RISC-V accelerated platform company targeting data analytics and Generative AI, has raised more than $250 million in its oversubscribed Series A-3 funding round, and Matrix Capital Management, the largest investor in this round, has joined the Board represented by Romit Shah. The funding saw participation from new investors including Intel […]

Anvilogic Closes $45 Million Series C

PALO ALTO — Anvilogic, the industry’s first multi-data platform SIEM, has closed a $45 million Series C funding round, bringing its total funding to date to $85 million since its founding in 2019. The round was led by Evolution Equity Partners, with participation from existing investors Foundation Capital, Cervin Ventures, Myriad Ventures, Point72 Ventures, Outpost Ventures, Stepstone Group, and G Squared. Capitalizing on […]

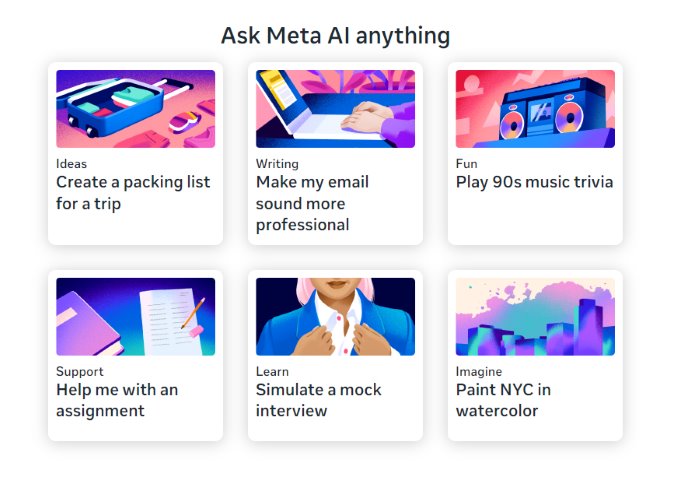

Meta Launches AI Assistant on Facebook, Instagram, Whatsapp

Meta, parent of Facebook, is launching Meta AI built with Llama 3, already on your phone, in your pocket for free. And it’s starting to go global with more features. You can use Meta AI on Facebook, Instagram, WhatsApp and Messenger to get things done, learn, create and connect with the things that matter to […]

Khosla Ventures Leads $30 Million Round in Anrok

SAN FRANCISCO — Anrok, a global sales tax platform for software companies, has raised $30 million in a Series B funding round led by Khosla Ventures, with participation from Sequoia Capital, Index Ventures, and others including Karen Peacock, former CEO of Intercom, David Faugno, former CFO of Qualtrics and current president of 1Password, Alex Estevez, […]

Apple to Offer Repair Options With Used Parts

Apple announced an upcoming enhancement to existing repair processes that will enable customers and independent repair providers to utilize used Apple parts in repairs. Beginning with select iPhone models this fall, the new process is designed to maintain an iPhone user’s privacy, security, and safety, while offering consumers more options, increasing product longevity, and minimizing […]

Dave and Buster’s Unveils 20 New Food Items

Dave & Buster’s – the national chain for food and family entertainment – is celebrating the launch of a new dine-in menu featuring more than 20 new premium food and drink items. In celebration, the brand is offering a first-of-its-kind offer for new and existing D&B Rewards members, who are eligible to receive 50% off […]

Plug and Play Unveils First Startup Batches of 2024

SUNNYVALE — Plug and Play, the startup accelerator platform, announces the acceptance of its batches of startups to participate in their first programs of the year, most of which will run out of their Silicon Valley headquarters and present at their Silicon Valley Summit. These programs will continue until June, with a focus on the following […]

Home Depot Extends Partnership With Google Cloud

Google Cloud and The Home Depot, the nation’s largest home improvement chain, have announced an extension of their multi-year relationship that will help the company accelerate its technology strategy and help customers complete their home improvement projects more efficiently and affordably. The two companies have collaborated closely since 2015 to innovate retail technology, all to […]

Police Investigating Palo Alto Burglary

PALO ALTO, CA – Police are investigating a burglary of an occupied home that occurred early Wednesday morning in Palo Alto. On Wednesday, April 10, 2024, at about 5:41 a.m., the 24-hour dispatch center received a call reporting a burglary that had occurred the night before at a home in the 900 block of Ilima Way. […]